Cosmetic & General Dentistry Services

HELPING PATIENTS ACHIEVE THEIR BEST POSSIBLE SMILES.

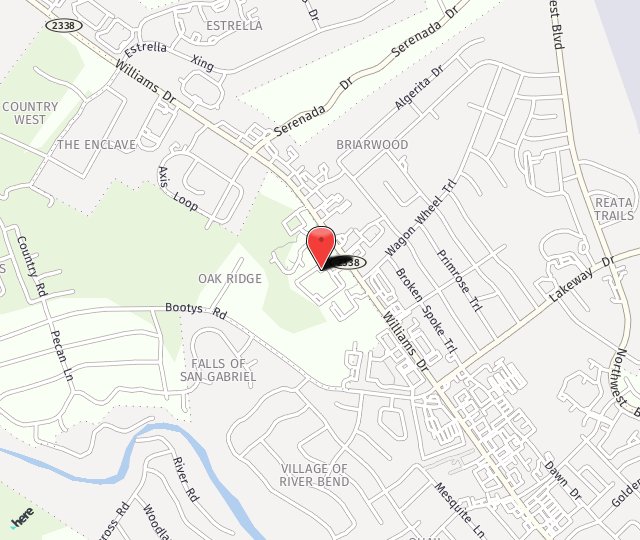

Cosmetic & Family Dentists in Georgetown, TX

Aesthetic Dentistry Georgetown

Since Dr. Mandy opened the practice in 2005, Aesthetic Dentistry has been dedicated to a relationship-centered approach to the finest care available. This means that while it is always the patient’s option, we must be aware of the most advanced care dentistry offers, and ensure that you have the opportunity to select the treatment that matches your dental goals and situation. Your experience will be grounded in a ‘Whole Health’ approach, ensuring your awareness of your dental health as well as its impact on the rest of your body and quality of life. Dr. Mayo, one of the founders of Mayo Clinics, stated that “a person with a healthy mouth lives an average of 10 years longer” and that is even more true today!

Many people don’t have great dental health or love their smile. At Aesthetic Dentistry of Georgetown, we create beautiful healthy smiles and give you options to keep your teeth for life.

Awards & Accolades

Featured Services

Meet Our Dedicated Whole Health Dental Team

Our highly trained team is committed to providing you with the best dental experience possible. With a dedication to growth in their careers in the field of dentistry, our team knows what it takes to keep our patients comfortable and their smiles healthy and beautiful.

Dr. Mandy Holley

Dr. Mandy Holley has been practicing the art of dentistry in Georgetown, Texas since 2002, after earning a degree in Biology from Texas Tech University and her DDS from the University of Texas Dental School in Houston. She combines her dental expertise with modern procedures and cutting-edge technology to treat sleep and breathing disorders, TMD and chronic pain issues, aesthetic and functional rehabilitation while designing beautiful and healthy smiles for her patients, and treating the various oral-systemic connections.

Dr. Mark Duncan

Dr. Mark Duncan has practiced the art and science of dentistry since 1995. A graduate of University of Oklahoma, he has spent his career not only treating patients, but also teaching dentists from around the world advanced aesthetic and functional dentistry. Fortunate to enter the profession at a time of change, he has participated in the advancement of techniques that dramatically impact the quality of life for his patients. Whether in the elimination of chronic pain, or the management of airway and sleep, Dr. Duncan is among the practitioners who understand the connection between traditional dental care and whole health focus.

Dr. Devin Tompkins

Dr. Devin Tompkins is a graduate of Creighton School of Dentistry in Omaha. Dr. Devin understands the value of a relationship with patients as this is the best way to develop the right personalized treatment plan. With a passion for cosmetic dentistry, Invisalign, dental implants, and restorative work, she helps create the healthy smiles people want. Her favorite compliments came from patients with severe dental anxiety entrusting her with their care. In addition, her positive outlook on life and cheerful demeanor will reassure patients that they made the right choice in a dental home at Aesthetic Dentistry of Georgetown.

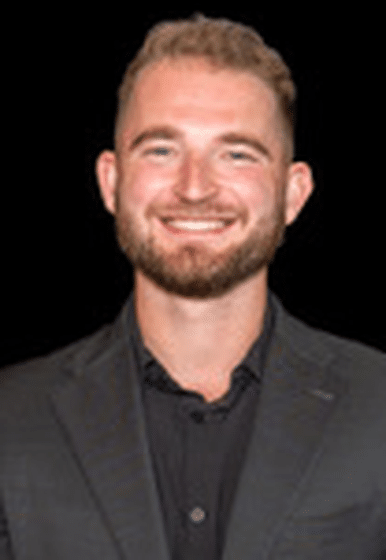

Dr. Chandler Herman

A proud graduate of The University of Texas Health Science Center School of Dentistry in San Antonio, Dr. Chandler Herman brings a deep-rooted passion for both dentistry and the Georgetown community he calls home. Initially moving to Georgetown in 2003, Dr. Herman is excited to return and lay down roots with his family in the town that shaped him.

Photo Gallery

We are passionate about providing our patients with the healthy, beautiful smiles they deserve. Visit our gallery to see real patient results.

Current Specials

New Patient Special

You will be blown away when you experience our 6 Screenings!

- Cleaning

- Comprehensive Exam

- X-rays

- 3D Imaging

- $750 value for only $199!

Invisalign®

-

Invisalign metal-free braces Limited time $2,000 off!

- Professional Zoom! Whitening

- Cases start as low as $199 a month

- Free Consultation

Cosmetic Dentistry

- $2,000 in savings (Smile Preview, Professional Whitening, Niteguard, Cleaning)

- Cases start as low as $199 a month

- Free Consultation